At state level, the USA is quite complex for share plans, but most of the states have exemptions for employee share plans. Each state has its own securities laws and regulations (commonly referred to as “Blue Sky Laws”). Companies must comply with the registration or exemption requirements of each state in which plan participants are resident.

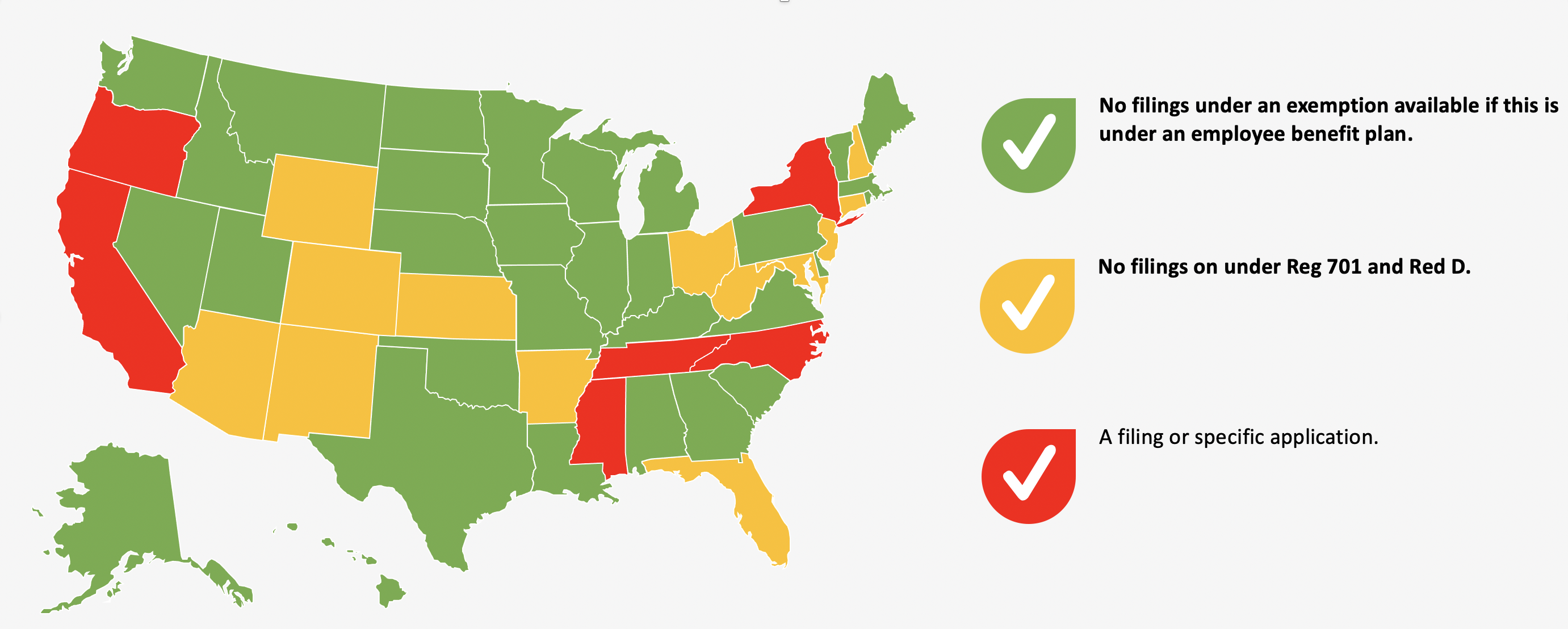

The laws of most states exempt from registration a security or investment contract “issued in connection with an employee stock purchase, savings, pension, profit-sharing, or similar benefit plan,” which is broadly interpreted to include most equity compensation plans. Several states require relatively simple notice filings – these are shown in the map below. Non-compliance with these laws could result in liabilities, such as rescission rights, fines or sanctions. Our map below shows the states where companies are usually exempt from filings, and also highlights those, like California and New York, which usually require some legal compliance work. The ShareReporter team is always available to help explain matters in more detail, and our partners at CMS can get the legal work done for your company plan. Just get in touch for more details.