Trusted by 70+ innovative companies around the world

Sign up for our industry-leading global update emails

Every month we send out our acclaimed global updates, with all the tax and legal changes you need to know. Please sign up here using our simple form - you can unsubscribe at any time.

Innovative solutions for companies

ShareReporter creates innovative online solutions for companies operating international share plans. Our applications allow businesses to do their compliance work on their share plans efficiently and inexpensively. We cover both tax and legal issues, for all the major award types, and our aim is to provide accessible, clear and practical information. For advisors, you have everything you need to help your clients with international share plans compliance, and you can have 40 countries absolutely free. Find out more on our Share | Advisor service.

Practical, up-to-date and accurate information

Our quality information is underpinned by our law firm partners, CMS and their global network. The ShareReporter expert team has over 25 years experience of share plans compliance. The focus is on easy-to-use, intuitive technology. You are in good hands.

We can provide all the information you need about global equity

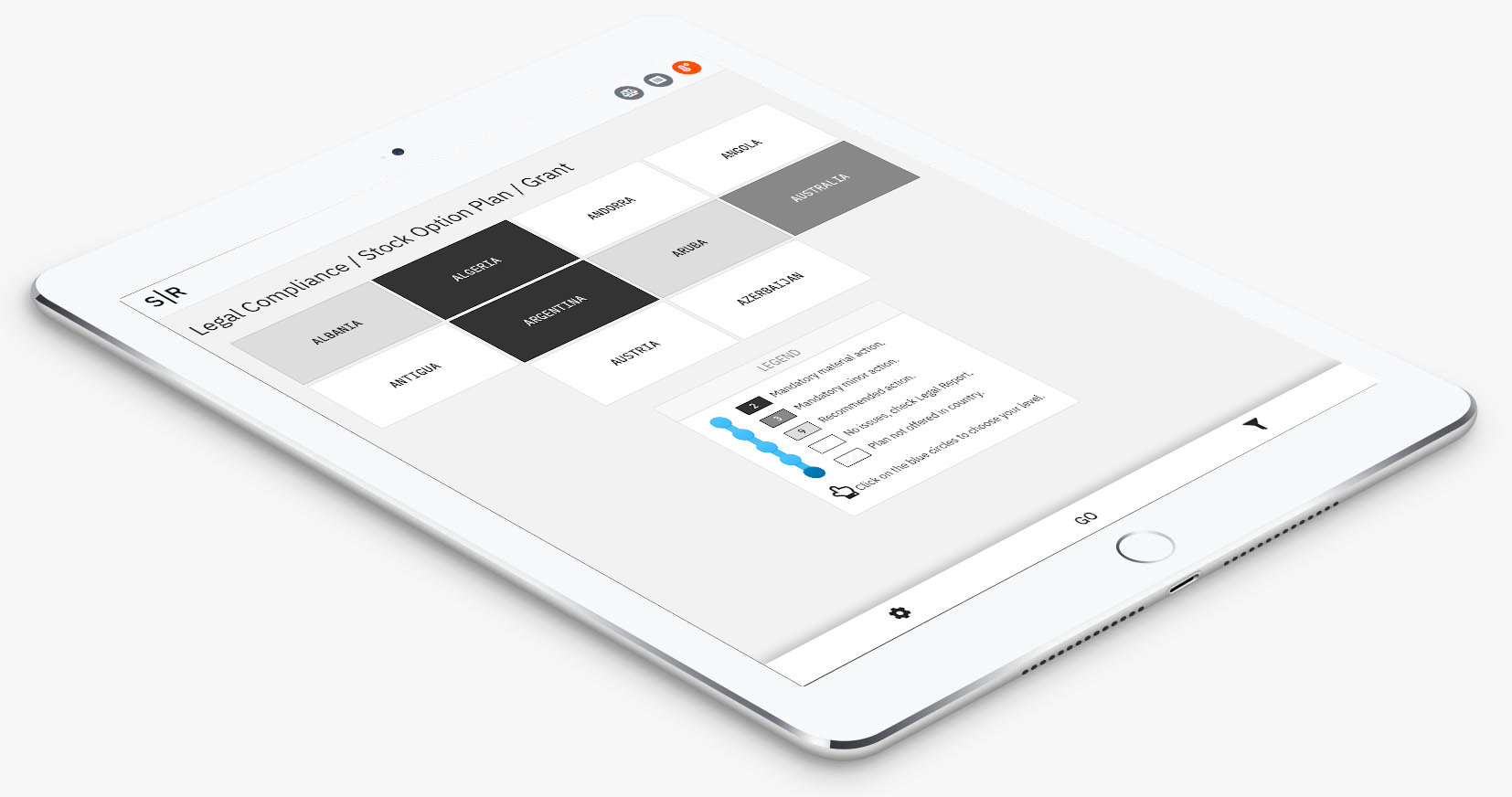

Share | Compliance is our flagship application, giving companies and providers all the legal and tax information you need for 90+ countries, with the full range of share plans, such as stock option plans, matching plans, RSUs etc. See where you need to do withholding, and get tax rates, reporting regulations, exchange controls etc. We can advise local lawyers through our CMS global network.

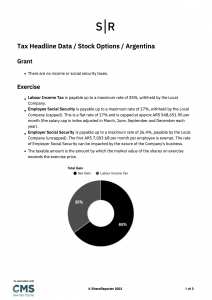

Download reports in PDF, Excel or Word

One of our key features is the ability to download detailed and customised reports directly from the platform, in the format that suits your needs, from PDFs to Excel and Word files.

Tax Guides Legal report Payroll Guides

A trusted global partner

We have been working in the employee stock plans sector since 1994 while our legal partner, CMS, is one of the 10 largest global law firms, made up of 18 independent law firms with 43 offices and over 1,400 lawyers. Working together, we have a top-quality global network in 100+ countries. This will give you all the legal and tax support you need.

Cost effective solutions

Reduce your compliance costs, and maximise your efficiency. We offer great value annual subscriptions and a guaranteed per country cost.

For start-ups and early growth companies

Our Share | Lite service is unbeatable value for start-ups and early growth companies, with a focus on the essential information you need to be compliant. If you don't want a subscription, we can provide you one-time reports with all the detail you need for €250 per country - just contact us for details.

If you have any questions about your share plan, then just get in touch.

Smart applications and smart products for global share plans

Share | Compliance

Share | Compliance is a fully customised platform for companies with a global share scheme, showing your plans, your employee numbers, your jurisdictions and your compliance position in each one. See what you need to do, and manage your compliance from within the application. All tax and legal compliance issues covered. Download reports in PDF or MS Excel and Word formats. This is the best choice for global companies.

Share | Lite

Share | Lite is designed especially for start-ups and early growth companies, with all the tax and legal information you need, at an unbeatable price. Instant online sign-up, and a truly focused, commercial approach to compliance. Cut through the clutter to see what really matters.

Share | Advisor

Share | Advisor is our solution for law firms, share plan administrators, cap table providers, plan consultants and accountancy firms. Get all the information you need, drawing on the global information within our platform. We have a range of options, from completely free summaries of the main tax and legal position, to giving our Advisor partners the ability to create customised reports, directly from our platform. We also offer customised tax and legal guides for local companies and participants - these are available as PDFs or MS Word documents. Share information directly with your team and your clients.

Share | Guides

Share | Guides is a unique solution for companies to make sure your plan participants have all the information they need, in every country covered by your plan. We offer customised tax and legal guides for participants - these are available as PDFs or MS Word documents, or we can set you up with a fully customised mobile app. Share information directly with your participants and/or via your plan administrator. The information is always up to date and accurate.

Our Global Network

Europe

Including all the 26 EU States, Albania, Belarus, Bosnia and Herzegovina, Iceland, Isle of Man, Moldova, Montenegro, North Macedonia, Russia, Switzerland, Turkey, Ukraine and the UK

Asia

Afghanistan, Armenia, Azerbaijan, Bangladesh, Belarus, China, Hing Kong, India, Indonesia, Iran, Iraq, Israel, Japan, Jordan, Kazakhstan, Korea South, Lebanon, Malaysia, Pakistan, Philippines, Saudi Arabia, Singapore, Taiwan, Tajikistan, Thailand, UAE, Vietnam

Americas

Argentina, Bermuda, Bolivia, Brazil, Canada, Chile, Costa Rica, Ecuador, Mexico, Nicaragua, Panama, Paraguay, Peru, Uruguay, USA

Africa

Algeria, Botswana, Cameroon, Egypt, Ethiopia, Kenya, Mauritius, Morocco, Nigeria, Rwanda, South Africa, Tanzania, Zambia, Zimbabwe

Australasia

Australia, Fiji, New Zealand, Samoa, Tonga

Rest of the world

We currently support 100+ countries around the world. However, if you need any other country please do contact us and we can produce this information and add these to the ShareReporter Platform.