How complicated are the state-level securities laws in the US?

At state level, the USA is quite complex for share plans, but most of the states have exemptions for employee share plans. Each state has its own securities laws and regulations (commonly referred to as “Blue Sky Laws”). Companies must comply with the registration or exemption requirements of each state in which plan participants are resident.

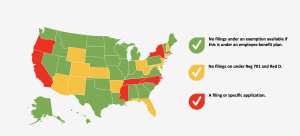

The laws of most states exempt from registration a security or investment contract “issued in connection with an employee stock purchase, savings, pension, profit-sharing, or similar benefit plan,” which is broadly interpreted to include most equity compensation plans. Several states require relatively simple notice filings – these are shown in the map below. Non-compliance with these laws could result in liabilities, such as rescission rights, fines or sanctions. Our map below shows the states where companies are usually exempt from filings, and also highlights those, like California and New York, which usually require some legal compliance work. The ShareReporter team is always available to help explain matters in more detail, and our partners at CMS can get the legal work done for your company plan. Just get in touch for more details.

When is an employee not an employee?

ShareReporter attended one of the most important events in the global equity sector recently. The Global Equity Organization is the world’s leading body for professionals working in the field of international share plans, and their Pan European Regional Event brought together industry experts from throughout Europe and beyond. ShareReporter’s CEO, Mike Pewton, spoke on the topic of “When is an employee not an employee?” in a panel alongside Sarah McMaster, a global equity expert from CMS’s Employee Incentives Team and Philip Newbald, Director of Finance Operations and equity product lead from OysterHR (a client and platform partner of ShareReporter). This panel looked at issues around granting equity globally to individuals employed via global employment platforms like Oyster, often called Employers of Record (EORs).

The panel addressed some of the key issues facing companies with global share plans. As well as ensuring the company’s documentation permitted the grant of equity awards to these types of employees, the legal and tax implications of granting were discussed.

Where participants are employed through an external organisation such as an EOR, then the companies need to know when taxes will arise, how taxes relating to the equity awards are paid and which entity will be responsible for any withholding and reporting obligations. Many jurisdictions will expect the EOR to withhold taxes in the same way on equity awards they do when withholding income taxes through the payroll. The participant will then usually be responsible for any capital gains that arise when selling the shares, and it is important that participants are kept informed about the taxes.

Other issues include ensuring that the documentation and communications between the company, the EOR and the participant were appropriate.

The panel was realistic about the overall compliance situation in this rapidly growing sector. The experts all agreed that there were many jurisdictions that had yet to incorporate this specific method of employment into their tax rules, and therefore that companies with distributed workers need to get some legal advice where necessary. In most cases, though, if the EOR withholds taxes then this is likely to be acceptable to (if not a requirement of) the tax authorities. This approach is very much embraced by Oyster, which, in partnership with ShareReporter, is looking to help its client companies handle equity for its team members.

It was great to see this important and growing employment trend examined in detail at such an important equity occasion, attended by numerous global companies. We expect more and more businesses to employ global teams in this way, and it will be interesting to track changes in equity compliance as jurisdictions make tax rules for the distributed workforce.

Mike Pewton, Sharereporter CEO

Start-Ups and Share Plans – what you need to know

We love working with start-ups, and our compliance solutions are ideal for companies that have distributed teams, are fast-growing and want stock plan information that is clear, great value and gets the job done. We also have the support of the legal team at CMS to guide businesses at an advisory level, and we also partner with cap table providers such as Astrella. Here, Cathy Wears from the Employee Benefits team at CMS in the UK shares her experience of how to provide share options to an international team.

So, what is a Share Option?

A share option is simply a right to acquire shares in the future, at a price set today (the ‘exercise price’). There are variations of this, such a RSUs or conditional awards, but the premise is the same – your employees do not become shareholders unless and until they exercise their option by the paying the exercise price. This may be at a future exit, or you may allow your employees to become ‘real’ shareholders before then. The Option terms will cover this, including what will happen to options if an employee leaves the business.

Share options can be structured to be tax advantageous for the employee and your company – for example, the share option could be granted as an EMI option in the UK or an ISO in the US. Many other countries (especially in the EU) are working to make share plans for start-ups more attractive from a tax perspective.

De-mystifying the Option pool

The option pool is simply the amount of shares your shareholders and investors are willing to give away to employees (in other words, the maximum dilution they are prepared to suffer in order to incentivise the workforce). This is usually agreed in the shareholder or investment agreement and can be increased as the company grows and goes through subsequent investment rounds. There is no ‘one size fits all’ but a typical option pool for a start up is somewhere between 10% – 15%, but can be as high as 30% (or more). In many ways, the pool size is influenced by the sector in which your company operates – the tech sector tends toward larger pools. Your investors will also have strong opinions on option pool size.

It is important to consider what equity you will need to incentivise your current workforce, leaving sufficient ‘headroom’ to attract strategic hires. It helps to do a ‘back of the envelope’ calculation as to how the percentages allocated to employees equate to the (realistic!) potential exit value for the company.

Keeping on top of your Equity

It is really important to stay on top of your cap table. Private companies tend, by their nature, to have many different share classes (preferred shares, growth shares etc) and a complex waterfall in the articles. Having a dynamic cap table management solution means that your founders, investors, employee and other shareholders know the percentage of equity they hold at any time. Some of the more sophisticated solutions will also allow you to model returns based on the current company valuation.

‘Accidental’ Global Employer

Increasingly companies are embracing flexible working, which has only been accelerated by the Covid lockdowns, and so some companies find themselves being ‘accidental’ global employers. This means your global workforce will be subject to tax in their own jurisdiction – so in respect of their share incentives, income tax may arise at different times, different rates and with different withholding obligations for your company. There may also be social security costs to be borne by your company. In addition, there may also be some legal issues to consider or filings to make. Failure to be aware of your compliance needs tends to lead to issues on a future due diligence (for example on an exit or investment) and so it is very worthwhile to get ahead of the game.

Cathy Wears, Of Counsel, CMS

How to do employee share plans compliance

Equity compliance for global employees is usually considered to be complex and expensive. Here, we give some useful tips as to how to get your approach right, and your costs low.

1) Believe you can do it!

Too many companies assume it is too difficult, and do not extend their equity to their international employees. Often, they offer cash as an alternative. This is such a shame – your overseas-based teams are just as motivated by an employee share plan as your ‘home country’ employees. Remember that thousands of companies around the world – big and small – manage to successfully operate their plans internationally.

2) Learn from other professionals

There are some excellent professional bodies for equity professionals, including the Global Equity Organization (https://www.globalequity.org/geo/index.php), and the National Association of Stock Plan Professionals (https://www.naspp.com). Many countries have national organisations promoting employee share ownership, such as ProShare in the UK (https://www.proshare.org). Joining these organisations is an excellent way of learning from others and seeking advice. Some of them have messageboards where information is exchanged, and this is a great way to share experience.

3) Get your plan design right

Good plan design is crucial, whether your plan is in one jurisdiction or multiple countries. When you are launching a plan internationally, take advice on the compliance consequences. Small adjustments to the plan before the launch can often make your life much easier.

4) Legal and tax issues are equally important

A share plan always has both regulatory and tax issues. You might have to make filings with national authorities, and there are sometimes annual tax declarations – both for the company and the participant. Plus, you need to be on top of the tax consequences of the different phases of your plan – for the parent company, the local company and, not least, the participants themselves.

5) Use professional advice carefully

Costs can quickly run out of control if you engage specialist advice in every country. By identifying key issues at the outset, you can control your budget and avoid paying top dollar for routine work.

6) Look at the technology options

A few specialists (like ShareReporter!) have set up databases of international regulatory and tax information. These can help reduce costs significantly, and give you a practical, commercial view of the issues. They are usually regularly updated, and available on a subscription basis, meaning the ongoing compliance can be budgeted.

7) Don’t forget employee communications

Companies tend to focus on employee communications to encourage take-up of the share plan, but then neglect to keep the participants up to date about the plan during its lifespan. Employees need to understand the tax (and sometimes regulatory) issues of the plans, and giving them tax guides for their country is recommended.

8) Some countries might be ‘impossible’ – it’s best to accept this reality

There are some countries where running your plan may just prove so difficult that it best to take a pragmatic view and accept that you will have to exclude them from the standard plan. Giving a cash alternative is a perfectly acceptable way to go.

9) Employee numbers make a difference

It is often assumed that it not worth operating a share plan in a country where you only have a handful of employees. In reality, the opposite can be true and your compliance risk rises with employee numbers. This is especially the case with security law filings.

10) Work with your administrator

The administrator of your share plan is a key ally, and should be able to offer some practical tips as to how other companies deal with international issues.

Mike Pewton, Sharereporter CEO